LEND

What is LEND?

LEND is a natural extension of the TEN Finance Ecosystem and a decentralized lending protocol for individuals and protocols to access financial services. The protocol is completely permissionless, transparent, and totally non-custodial. The LEND platform establishes pools of algorithmically derived interest rate model, based on current supply and demand of each respective asset.

Users can use LEND to lend any supported assets on our markets for others to borrow and earn interest, and also use the provided capital as collateral to borrow another supported asset. LEND opens up the possibility of lending and borrowing crypto assets without the need to negotiate terms of maturity, interest rate or collateral with any peer or counter-party. LEND offers a wide range of tokens on our money markets, support for different tokens will constantly be updated, and we will endeavour to always provide a market for the most liquid assets available.

Why LEND?

Lending protocols are not new to the DeFi ecosystem and there are many established protocols with multi-billions of dollars in value captured. By January 2022 the Total Value Locked (TVL) was well over $170 billion! Despite the DeFi space being very much in its infancy, that is still a tremendous amount of value captured by protocols that are still generally, overly complicated and very difficult for the average user to get onboarded. LEND aims to simplify this process and achieve financial inclusion for everyone. Providing true value to our users with no barriers to entry.

LEND was also designed to reward users with 'real yield' to create a sustainable and beneficial model to the entire TEN Finance ecosystem. LEND will use the platform's native token; $LEND, to distribute actual revenue generated back to our users. This feature will ensure LEND is free adapt and evolve alongside the DeFi space by ensuring we give real utility to $LEND.

The purpose of $LEND?

The main purposes of the $LEND token is to create 'real yield' by rewarding users with an actual share of the revenue generated by the protocol. $LEND will also be used to incentivise supplying assets on the LEND platform and will allow us to get as many users involved as possible in the governance of the protocol. Currently $LEND has three main uses: staking, locking and voting. Those three things will require you to supply your $LEND and acquire $tLEND.

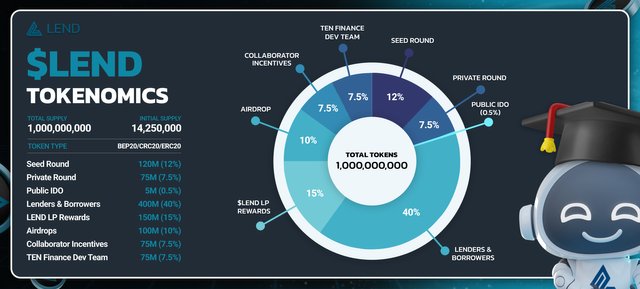

Tokenomics

TOKEN SYMBOL: LEND

TOKEN TYPE: BEP20/ERC20

TOTAL SUPPLY: 1,000,000,000

INITIAL SUPPLY: 14,250,000

INITIAL MARKETCAP: TBA

Token Allocations

12% - 120,000,000 LEND Allocated for Seed Round

5% at TGE, 4 month cliff with linear vesting from months 5 -> 15 at 8.64% per month

7.5% - 75,000,000 LEND Allocated for Private Round

10% at TGE, 3 month. cliff with linear vesting from months 4 -> 12 at 10.00% per month

0.5% - 5,000,000 LEND Allocated for Public IDO

15% at TGE, 1 month cliff with linear vesting for 5 months at 17% per month

40% - 400,000,000 LEND Allocated for Lenders & Borrowers

15% - 150,000,000 LEND Allocated for LEND LP Rewards

10% - 100,000,000 LEND Allocated for Airdrops

3 month cliff, 25% released every 90 days, must hold TENFI tokens to maintain airdrop, otherwise defaulted into rewards pool

7.5% - 75,000,000 LEND Allocated for Collaborator Incentives

3 month cliff, 25% released every 90 days

7.5% - 75,000,000 LEND Allocated for TEN Finance Dev Team

24 month cliff, then linear vesting over 5 years

.jpg)

The utility of $LEND?

$LEND tokens are the key to earning real yield from the LEND protocol. Within the $LEND token structure the token will give holders governance and voting rights in important decisions for shaping the future of the platform. So by holding $LEND you'll be able to have a say in the future direction of the protocol.

$LEND tokens are also the key to earning passive income from our ecosystem. Once the token has launched, holders can supply $LEND to the protocol in exchange for $tLEND which actually makes them eligible to earn a large portion of the total revenue generated by the protocol.

Steve takes his $LEND tokens, supplies it to the Money Markets on app.ten.finance -> Steve then receives $tLEND tokens as a deposit receipt. Holding $tLEND allows him to also receive additional $LEND tokens as an incentive for supplying his tokens to the market.

ROADMAP

Conclusion

The platform is built on the LEND token which has several key features that make it unique. The token is used as the medium of exchange between investors and borrowers. All transactions are done using LEND tokens. This insures that there will be a limited supply of tokens in the market. This in turn will allow it to appreciate in value over time. The tokens are used to pay for the transaction fees on the platform. These fees will be determined by the platform.

For More Information:

Website: https://www.lend.finance/

Whitepaper: http://lend.gitbook.io/

Telegram: http://t.me/lendfinance

Twitter: http://twitter.com/lend_finance

Github: https://github.com/tenfinance

Medium: https://medium.com/lendfinance

AUTHOR INFO:

Bitcointalk Username: Dwi Aprilani

BitcoinTalk Profile URL: https://bitcointalk.org/index.php?action=profile;u=3241566

Gmail: amstelyalle@gmail.com

Wallet Address: 0x5684e5eCc07C92e119BaCD5e1C34D699abF5bd5F

Tidak ada komentar:

Posting Komentar